June 10, 2025 – Vancouver, BC - Orezone Gold Corporation (TSX: ORE, OTCQX: ORZCF) (the “Company” or “Orezone”) is pleased to provide additional drill results from its ongoing multi-year exploration campaign at its flagship Bomboré Gold Mine. These latest results are from multiple targets identified along the broader 14km long reserve defined Bomboré gold system, which remains open for further expansion.

Selected Drill Highlights1:

- 11.33g/t Au over 11.00m (BBC6960)

- 10.28g/t Au over 5.00m (BBC7132)

- 6.79g/t Au over 8.00m and 2.22g/t Au over 14.00m (BBC7141)

- 7.40g/t Au over 6.70m (BBD1124)

- 6.61g/t Au over 4.15m (BBD1341)

- 2.96g/t Au over 10.00m (BBC7158)

- 1.84g/t Au over 15.70m (BBD1346)

- 1.53g/t Au over 17.00m (BBC7148)

- 1.45g/t Au over 14.10m (BBD1344)

- 1.23g/t Au over 9.65m (BBD1329)

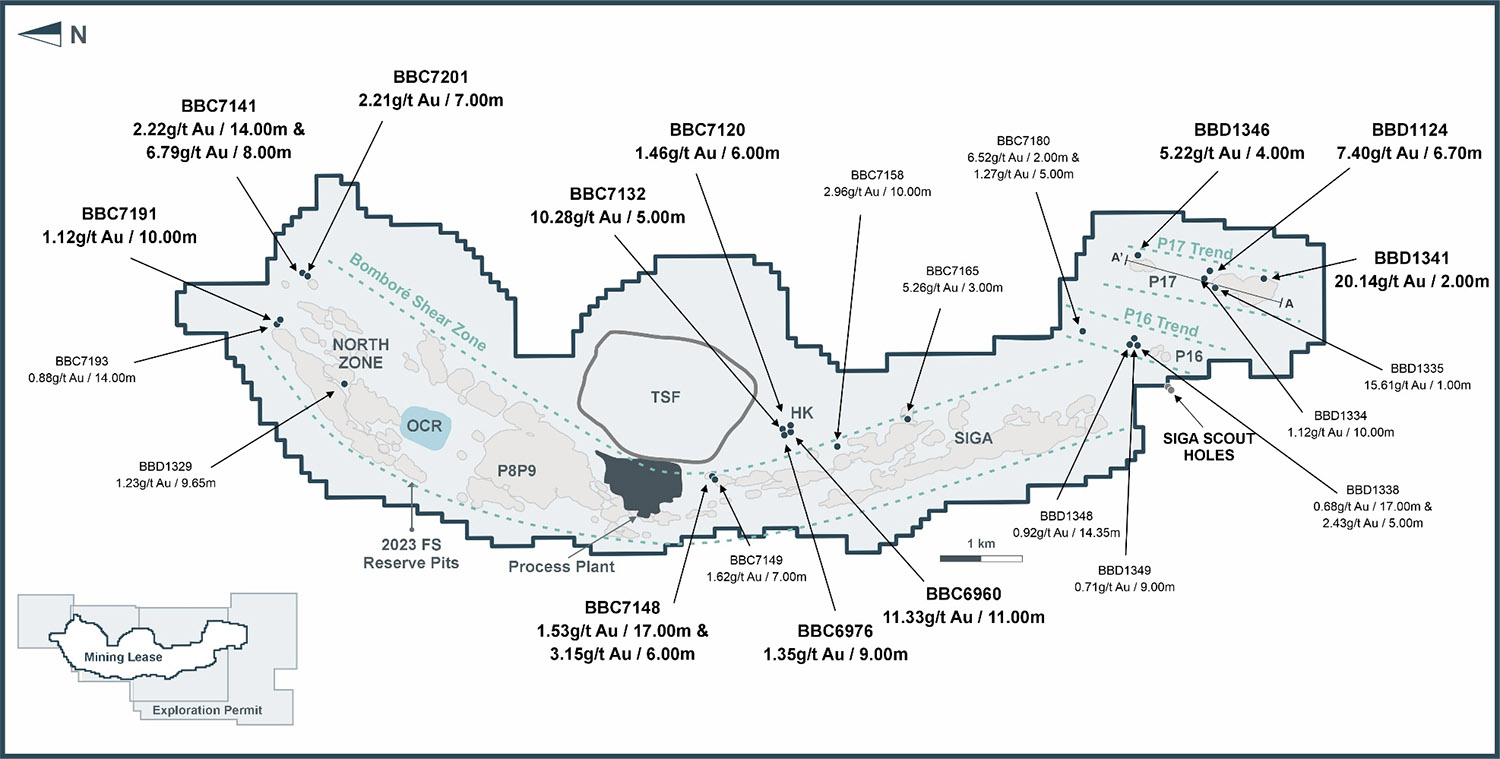

Patrick Downey, President and CEO stated, “These latest drill results further underscore the significant exploration upside at Bomboré and clearly illustrate that the broader system remains open to depth, along strike and outside of the currently delineated mineralized trends. At P17, drilling was successful in tracing higher-grade sub-zone mineralization a further 300m down plunge, while wide spaced step-out drilling at P16 and Siga have extended mineralization a respective 600m and 550m along strike. As we ramp up our exploration efforts at Bomboré, we continue to re-evaluate and update the project’s existing exploration framework. The latest results also provide clear evidence that the hanging wall and footwall of the broader 14km long reserve defined system are prospective for additional near-surface discoveries, which was not previously recognized.

While Bomboré currently hosts a stated 5 million ounce global resource, which is the basis for the ongoing production expansion to 220,000 to 250,000 ounces per annum, the results of the current exploration program continue to provide support for the Company’s long-term targeted resource base of 7 to 10 million ounces.”

P17 Trend: Higher-Grade Sub-Zones

Drilling at P17 was successful in further illustrating the down plunge continuity of the higher-grade sub-zones, the highlight of which was an intercept of 7.40g/t Au over 6.70m (BBD1124), which marks a 300m down plunge extension from the previously reported 11.52g/t Au over 10.60m (BBD1081, Figure 3). Other notable sub-zone intercepts from this recent round of drilling include 5.22g/t Au over 4.00m (BBD1346), 20.14g/t Au over 2.00m (BBD1341) and 15.61g/t Au over 1.00m (BBD1335).

While the Company continues to define the structural setting of the P17 Trend, and further develop a predictive model for future sub-zone targeting, a key takeaway from the recent drilling was a better understanding of the controls of the higher-grade mineralization which comprise these sub-zones. It is now recognized that the higher-grades are associated with a later-stage quartz veining event, within which multiple occurrences of visible gold were observed for the first time (Figure 1). This marks an important development in the Company’s understanding of the Bomboré system, which to date has been focused on a low grade, bulk tonnage open pit model. While still early-stage, the Company continues to evaluate the sub-zones along the P17 Trend, and other localized higher-grade areas along the broader 14km system, as future potential sources of higher-grade underground feed, beneath the open pits.

Figure 1: P17 Drill Core Photos – highlighting visible gold within higher-grade sub-zone

P17 Trend: selected high-grade sub-zone intercepts (previously reported):

- 14.67g/t Au over 6.0m (BBD1066)

- 16.58g/t Au over 4.6m (BBD0991)

- 11.52g/t Au over 10.6m (BBD1081)

- 9.44g/t Au over 10.0m (TYD0041)

- 8.47g/t Au over 6.0m (BBD1132)

- 7.08g/t Au over 7.0m (TYC0123)

- 7.62g/t Au over 5.5m (TYD0035)

Near Surface Strike Extensions

In addition to extending the Bomboré mineral system to depth, and defining higher-grade sub-zones within, further delineating near-surface strike extensions to multiple resource areas continues to be another important area of investigation. A highlight of such recent targeting was at P16, where a series of step-out holes successfully identified mineralization an additional 600m to the north (Figure 2), as supported by intercepts of 0.92g/t Au over 14.35m (BBD1348), 0.71g/t Au over 9.00m (BBD1349), 0.68g/t Au over 17.00m (BBD1338) and 1.27g/t Au over 5.00m (BBC7180). These initial step-out results support the interpretation that P16 is a sub-parallel trend to the P17 Trend, which significantly expands the exploration model and potential within this area of the project.

Future targeting of the P16 strike extension will be centered on backfill drilling, with the goal of delineating open pittable near-surface mineralization, as well as to further investigate the potential for higher-grade sub-zones, as is observed within the P16 resource area.

P16 Trend: selected high-grade sub-zone intercepts (previously reported):

- 10.63g/t Au over 14.0m (BBD0448)

- 16.50g/t Au over 5.0m (BBD0448)

- 9.03g/t Au over 12.0m (BBC3241)

- 6.69g/t Au over 15.5m (BBD0443)

- 5.91g/t Au over 15.0m (BBD0447)

- 7.82g/t Au over 9.0m (BBD0213)

- 58.91g/t Au over 3.0m (BBD0768)

At Siga, initial testing of the southern strike extension yielded encouraging results, with mineralization intercepted approximately 550m to the south of the current mineral resource. This area of the project has not been previously explored with results of the initial scout drilling returning 5.93g/t Au over 0.85m and 6.35g/t Au over 1.00m (BBD1340). Follow-up drilling will comprise a series of wide spaced backfill fences to further delineate this broad southern extension.

Additionally, significant potential remains to extend resources to the north of the existing open pit designs in the North Zone. Localized 50-100m step-outs along the broader North Zone strike extension have demonstrated promising continuity, with initial results of 2.22g/t Au over 14.00m and 6.79g/t Au over 8.00m (BBC7141) and 2.21g/t Au over 7.00m (BBC7201). Further drilling along this northern strike extension, which has seen limited testing to date, is planned for upcoming campaigns.

Expanding Exploration Model

In addition to testing the extent of known mineralization, the Company continues to challenge the broader exploration model at Bomboré. The previously established exploration framework was centered on gold mineralization being confined to the Bomboré Shear Zone, with limited prospects within the hanging wall and footwall of the broader system. However, more recent targeted drilling, and local surface excavations outside of the mining lease, provide evidence to the contrary. Initial testing within the immediate hanging wall to the Siga Zone has led to the discovery of the HK Zone (Figure 2), which is marked by intercepts of 11.33g/t Au over 11.00m (BBC6960), 10.28g/t Au over 5.00m (BBC7132), 1.35g/t Au over 9.00m (BBC6976), and 1.46g/t Au over 6.00m (BBC7120).

With the prospects of identifying additional high-grade centers of mineralization outside of the Bomboré Shear Zone, the Company has recently commenced a near-mine and regional air core drill program, comprising a series of wide spaced drill fences within the mining lease and surrounding exploration tenements.

Figure 2 – Bomboré Plan Map Highlighting Selected Intercepts

Figure 3 – P17 Composite Long Section Highlighting Selected Intercepts (Looking West)

Table 1 – Highlight Drill Intercepts

| Hole | Zone | Easting | Northing | Elv. | Dip | Azi. | EOH (m) |

From (m) |

To (m) |

Length* (m) |

Grade (g/t Au) |

Type |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| BBD0206 | P17 | 730599 | 1344300 | 267 | -50 | 270 | 155 | 125.00 | 128.00 | 3.00 | 1.79 | HR |

| BBD1069 | P17 S | 730270 | 1343125 | 261 | -51 | 270 | 277 | 225.00 | 226.00 | 1.00 | 9.53 | HR |

| and | 251.75 | 260.60 | 8.85 | 1.39 | HR | |||||||

| incl. | 257.60 | 259.60 | 2.00 | 3.58 | HR | |||||||

| BBD1084 | P17 S | 730355 | 1343175 | 261 | -52 | 270 | 437 | 314.00 | 317.95 | 3.95 | 2.36 | HR |

| BBD1104 | P17 S | 730365 | 1343250 | 261 | -52 | 269 | 401 | 355.00 | 358.00 | 3.00 | 2.09 | HR |

| incl. | 357.00 | 358.00 | 1.00 | 5.17 | HR | |||||||

| BBD1124 | P17 S | 730425 | 1343375 | 261 | -49 | 272 | 495 | 459.00 | 465.70 | 6.70 | 7.40 | HR |

| and | 480.00 | 485.00 | 5.00 | 2.09 | HR | |||||||

| BBD1131 | North Zone | 730395 | 1343325 | 261 | -51 | 270 | 452 | 395.00 | 398.00 | 3.00 | 1.66 | HR |

| and | 416.00 | 419.00 | 3.00 | 1.01 | HR | |||||||

| and | 425.00 | 428.30 | 3.30 | 1.82 | HR | |||||||

| BBD1329 | North Zone | 729034 | 1353901 | 283 | -55 | 312 | 396 | 341.35 | 351.00 | 9.65 | 1.23 | HR |

| and | 356.50 | 362.50 | 6.00 | 1.53 | HR | |||||||

| BBD1331 | North Zone | 728993 | 1353501 | 276 | -52 | 312 | 330 | 42.00 | 43.00 | 1.00 | 8.06 | OX |

| BBD1334 | P17 S | 730483 | 1343350 | 261 | -53 | 271 | 519 | 278.10 | 283.10 | 5.00 | 1.72 | HR |

| and | 488.50 | 498.50 | 10.00 | 1.12 | HR | |||||||

| incl. | 494.50 | 497.50 | 3.00 | 2.51 | HR | |||||||

| BBD1335 | P17 S | 730257 | 1343350 | 261 | -50 | 270 | 396 | 47.00 | 48.00 | 1.00 | 15.61 | HR |

| BBD1338 | P16 | 729508 | 1344364 | 259 | -45 | 263 | 291 | 193.00 | 210.00 | 17.00 | 0.68 | HR |

| incl. | 202.00 | 206.00 | 4.00 | 1.20 | HR | |||||||

| and | 257.00 | 262.00 | 5.00 | 2.43 | HR | |||||||

| and | 268.00 | 271.20 | 3.20 | 1.10 | HR | |||||||

| BBD1339 | P16 | 729597 | 1344551 | 260 | -50 | 270 | 336 | 334.00 | 336.00 | 2.00 | 2.95 | HR |

| BBD1340 | P16 | 729000 | 1343900 | 260 | -50 | 270 | 201 | 89.15 | 90.00 | 0.85 | 5.93 | HR |

| and | 191.00 | 192.00 | 1.00 | 6.35 | HR | |||||||

| BBD1341 | P17 S | 730336 | 1342750 | 261 | -50 | 270 | 156 | 123.75 | 127.90 | 4.15 | 6.61 | HR |

| incl. | 125.90 | 127.90 | 2.00 | 20.14 | HR | |||||||

| BBD1343 | P17 S | 730392 | 1343125 | 261 | -55 | 270 | 360 | 309.00 | 313.00 | 4.00 | 1.03 | HR |

| BBD1344 | P17 S | 730371 | 1343501 | 261 | -50 | 270 | 528 | 323.00 | 337.10 | 14.10 | 1.45 | HR |

| incl. | 323.00 | 332.70 | 9.70 | 1.87 | HR | |||||||

| and | 428.00 | 431.00 | 3.00 | 1.79 | HR | |||||||

| BBD1345 | P17 S | 730340 | 1342800 | 261 | -50 | 270 | 165 | 136.20 | 139.80 | 3.60 | 1.68 | HR |

| and | 146.00 | 148.55 | 2.55 | 5.02 | HR | |||||||

| BBD1346 | P17 S | 730618 | 1344250 | 266 | -50 | 270 | 225 | 137.25 | 141.00 | 3.75 | 1.17 | HR |

| and | 178.00 | 193.70 | 15.70 | 1.84 | HR | |||||||

| incl. | 186.70 | 190.70 | 4.00 | 5.22 | HR | |||||||

| BBD1348 | P16 | 729566 | 1344413 | 259 | -50 | 270 | 303 | 168.00 | 173.15 | 5.15 | 1.54 | HR |

| and | 214.00 | 228.35 | 14.35 | 0.92 | HR | |||||||

| incl. | 222.00 | 228.35 | 6.35 | 1.03 | HR | |||||||

| and | 260.00 | 266.00 | 6.00 | 0.81 | HR | |||||||

| BBD1349 | P16 | 729517 | 1344443 | 259 | -50 | 270 | 312 | 241.00 | 250.00 | 9.00 | 0.71 | HR |

| and | 255.00 | 270.00 | 15.00 | 0.57 | HR | |||||||

| BBC6946 | HK | 728515 | 1348358 | 277 | -50 | 270 | 60 | 13.00 | 17.00 | 4.00 | 2.53 | OX |

| BBC6958 | HK | 728560 | 1348357 | 276 | -50 | 270 | 75 | 70.00 | 75.00 | 5.00 | 1.19 | OX |

| BBC6960 | HK | 728536 | 1348408 | 274 | -50 | 280 | 114 | 48.00 | 59.00 | 11.00 | 11.33 | OX |

| incl. | 48.00 | 51.00 | 3.00 | 40.12 | OX | |||||||

| BBC6962 | HK | 728829 | 1348272 | 278 | -50 | 250 | 129 | 56.00 | 62.00 | 6.00 | 0.68 | OX |

| BBC6963 | HK | 728844 | 1348280 | 277 | -50 | 279 | 131 | 74.00 | 78.00 | 4.00 | 0.80 | OX |

| BBC6975 | HK | 728537 | 1348357 | 276 | -50 | 270 | 96 | 84.00 | 93.00 | 9.00 | 0.65 | HR |

| BBC6976 | HK | 728564 | 1348402 | 275 | -50 | 280 | 113 | 74.00 | 83.00 | 9.00 | 1.35 | OX |

| BBC7120 | HK | 728557 | 1348302 | 276 | -50 | 270 | 100 | 69.00 | 75.00 | 6.00 | 1.46 | HR |

| BBC7122 | HK | 728563 | 1348386 | 275 | -50 | 270 | 120 | 78.00 | 87.00 | 9.00 | 0.78 | HR |

| BBC7129 | HK | 728603 | 1348435 | 274 | -50 | 270 | 120 | 110.00 | 117.00 | 7.00 | 0.79 | HR |

| BBC7132 | HK | 728524 | 1348333 | 278 | -50 | 270 | 130 | 26.00 | 30.00 | 4.00 | 0.72 | OX |

| and | 82.00 | 87.00 | 5.00 | 10.28 | HR | |||||||

| BBC7135 | HK | 728391 | 1348375 | 283 | -50 | 270 | 60 | 32.00 | 36.00 | 4.00 | 1.31 | OX |

| BBC7136 | HK | 728493 | 1348224 | 286 | -50 | 270 | 100 | 27.00 | 36.00 | 9.00 | 0.65 | OX |

| and | 46.00 | 50.00 | 4.00 | 0.76 | OX | |||||||

| and | 60.00 | 63.00 | 3.00 | 2.26 | OX | |||||||

| BBC7140 | North Zone | 729983 | 1354256 | 285 | -50 | 312 | 126 | 8.00 | 11.00 | 3.00 | 0.67 | OX |

| and | 16.00 | 25.00 | 9.00 | 0.53 | OX | |||||||

| incl. | 21.00 | 24.00 | 3.00 | 1.09 | OX | |||||||

| BBC7141 | North Zone | 730390 | 1354301 | 278 | -45 | 312 | 100 | 27.00 | 41.00 | 14.00 | 2.22 | OX |

| incl. | 27.00 | 30.00 | 3.00 | 8.44 | OX | |||||||

| and | 66.00 | 74.00 | 8.00 | 6.79 | HR | |||||||

| incl. | 67.00 | 70.00 | 3.00 | 14.82 | HR | |||||||

| BBC7142 | North Zone | 730082 | 1354338 | 282 | -50 | 312 | 152 | 109.00 | 114.00 | 5.00 | 1.51 | HR |

| BBC7147 | P11 | 727951 | 1349499 | 291 | -50 | 270 | 150 | 70.00 | 75.00 | 5.00 | 0.85 | HR |

| BBC7148 | P11 | 727932 | 1349408 | 292 | -50 | 270 | 120 | 32.00 | 49.00 | 17.00 | 1.53 | OX |

| incl. | 39.00 | 41.00 | 2.00 | 7.62 | OX | |||||||

| and | 77.00 | 83.00 | 6.00 | 3.15 | HR | |||||||

| incl. | 77.00 | 80.00 | 3.00 | 5.32 | HR | |||||||

| BBC7149 | P11 | 727950 | 1349449 | 291 | -50 | 270 | 150 | 90.00 | 97.00 | 7.00 | 1.62 | HR |

| BBC7150 | P11 | 727983 | 1349253 | 285 | -50 | 270 | 125 | 87.00 | 93.00 | 6.00 | 0.92 | HR |

| BBC7152 | P11 | 728107 | 1349249 | 281 | -50 | 270 | 120 | 74.00 | 77.00 | 3.00 | 1.64 | HR |

| BBC7153 | P11 | 728106 | 1349299 | 279 | -50 | 270 | 118 | 49.00 | 53.00 | 4.00 | 1.01 | OX |

| BBC7154 | P11 | 728013 | 1349400 | 282 | -50 | 270 | 150 | 98.00 | 100.00 | 2.00 | 1.47 | HR |

| and | 116.00 | 119.00 | 3.00 | 1.84 | HR | |||||||

| BBC7157 | Siga W | 727966 | 1347455 | 276 | -50 | 250 | 140 | 11.00 | 16.00 | 5.00 | 0.77 | OX |

| and | 90.00 | 101.00 | 11.00 | 0.96 | HR | |||||||

| BBC7158 | Siga E | 728340 | 1347910 | 283 | -50 | 250 | 120 | 67.00 | 77.00 | 10.00 | 2.96 | HR |

| incl. | 69.00 | 71.00 | 2.00 | 11.72 | HR | |||||||

| BBC7161 | Siga E | 728615 | 1347638 | 277 | -50 | 250 | 120 | 62.00 | 63.00 | 1.00 | 5.99 | HR |

| BBC7162 | Siga E | 728669 | 1347497 | 274 | -50 | 250 | 150 | 73.00 | 78.00 | 5.00 | 1.05 | HR |

| BBC7163 | Siga E | 728624 | 1347428 | 273 | -50 | 250 | 80 | 18.00 | 26.00 | 8.00 | 1.00 | OX |

| and | 30.00 | 33.00 | 3.00 | 1.35 | OX | |||||||

| BBC7164 | Siga E | 728681 | 1347449 | 271 | -50 | 250 | 114 | 42.00 | 47.00 | 5.00 | 1.23 | OX |

| BBC7165 | Siga E | 728647 | 1347090 | 280 | -50 | 250 | 126 | 96.00 | 99.00 | 3.00 | 5.26 | HR |

| incl. | 96.00 | 97.00 | 1.00 | 14.67 | HR | |||||||

| BBC7166 | Siga S | 728213 | 1345896 | 266 | -50 | 250 | 84 | 6.00 | 9.00 | 3.00 | 1.13 | OX |

| BBC7180 | P16 | 729608 | 1345000 | 261 | -50 | 270 | 72 | 47.00 | 49.00 | 2.00 | 6.52 | HR |

| and | 54.00 | 59.00 | 5.00 | 1.27 | HR | |||||||

| BBC7185 | P8P9 | 728636 | 1352003 | 267 | -50 | 312 | 123 | 2.00 | 8.00 | 6.00 | 0.63 | OX |

| BBC7186 | P8P9 | 728571 | 1351926 | 269 | -50 | 312 | 138 | 2.00 | 9.00 | 7.00 | 0.86 | OX |

| and | 64.00 | 71.00 | 7.00 | 0.82 | OX | |||||||

| incl. | 64.00 | 68.00 | 4.00 | 1.12 | OX | |||||||

| BBC7187 | P8P9 | 728527 | 1351968 | 268 | -50 | 312 | 136 | 133.00 | 136.00 | 3.00 | 1.62 | HR |

| BBC7191 | North Zone | 729740 | 1354677 | 284 | -49 | 310 | 69 | 5.00 | 15.00 | 10.00 | 1.12 | OX |

| incl. | 9.00 | 14.00 | 5.00 | 1.74 | OX | |||||||

| and | 30.00 | 35.00 | 5.00 | 0.59 | OX | |||||||

| BBC7193 | North Zone | 729758 | 1354661 | 282 | -51 | 310 | 114 | 25.00 | 34.00 | 9.00 | 0.47 | OX |

| and | 44.00 | 48.00 | 4.00 | 3.14 | OX | |||||||

| and | 53.00 | 67.00 | 14.00 | 0.88 | OX | |||||||

| BBC7195 | North Zone | 729774 | 1354680 | 282 | -51 | 310 | 113 | 47.00 | 49.00 | 2.00 | 2.58 | OX |

| BBC7200 | North Zone | 730379 | 1354345 | 286 | -50 | 310 | 80 | 12.00 | 20.00 | 8.00 | 0.62 | OX |

| and | 61.00 | 67.00 | 6.00 | 1.50 | HR | |||||||

| BBC7201 | North Zone | 730417 | 1354345 | 279 | -49 | 310 | 83 | 0.00 | 7.00 | 7.00 | 2.21 | OX |

| and | 12.00 | 20.00 | 8.00 | 0.62 | OX | |||||||

| and | 61.00 | 67.00 | 6.00 | 1.50 | HR |

* True widths for all zones are reported as a percentage of drilled lengths: North Zone 85%, P8/P9 70-85%, Siga 90%, P11 75-85%, P17S 70% and 90-100%, P17N 70% and HK 75-80%.

About Orezone Gold Corporation

Orezone Gold Corporation (TSX: ORE OTCQX: ORZCF) is a West African gold producer engaged in mining, developing, and exploring its 90%-owned flagship Bomboré Gold Mine in Burkina Faso. The Bomboré mine achieved commercial production on its oxide operations on December 1, 2022, and is now focused on its staged hard rock expansion that is expected to materially increase annual and life-of-mine gold production from the processing of hard rock mineral reserves. Orezone is led by an experienced team focused on social responsibility and sustainability with a proven track record in project construction and operations, financings, capital markets, and M&A.

The technical report entitled Bomboré Phase II Expansion, Definitive Feasibility Study is available on SEDAR+ and the Company’s website.

Contact Information

Patrick Downey

President and Chief Executive Officer

Kevin MacKenzie

Vice President, Corporate Development and Investor Relations

Tel: 1 778 945 8977

info@orezone.com / www.orezone.com

For further information please contact Orezone at +1 (778) 945 8977 or visit the Company’s website at www.orezone.com.

The Toronto Stock Exchange neither approves nor disapproves the information contained in this news release.

Qualified person

Alastair Gallaugher (CGeol), Exploration Manager for Orezone, is the Qualified Person under NI 43-101 and has reviewed and approved the scientific and technical information contained in this news release.

QA/QC

The mineralized intervals are based on a lower cut-off grade of 0.28g/t in the Oxide+Upper Transition zone, and 0.45g/t Au in the Lower Transition+Hard Rock zone. The half-core drilling samples were cut using a diamond saw by Orezone employees. The samples were prepared by BIGS Global Burkina s.a.r.l. (“BIGS Global”) and then split by Orezone to 1 kg using Rotary Sample Dividers (“RSDs”). A 1kg aliquot was analyzed for leachable gold at BIGS Global in Ouagadougou, by bottle-roll cyanidation using a LeachWellTM catalyst. The leach residues from all samples with a leach grade greater than or equal to 0.25g/t Au were prepared by BIGS Global and then split by Orezone to 50g using RSDs. A 50g aliquot was analyzed by fire assay at BIGS Global.

Orezone employs a rigorous Quality Control Program including a minimum of 10% standards, blanks and duplicates. The composite width and grade include the final leach residue assay results for most of the drill intercepts reported.

Cautionary Note Regarding Forward-Looking Statements

This press release contains certain information that constitutes “forward-looking information” within the meaning of applicable Canadian Securities laws and “forward-looking statements” within the meaning of applicable U.S. securities laws (together, “forward-looking statements”). Forward-looking statements are frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “potential”, “possible” and other similar words, or statements that certain events or conditions “may”, “will”, “could”, or “should” occur.

Forward-looking statements in this press release include, but are not limited to statements with respect to the exploration program and the significant exploration upside at Bomboré including that the broader system remains open to depth, along strike and outside of the currently delineated mineralized trends; the potential to materially expand the project’s resource base from the current global 5 million gold ounces, to a targeted 7 to 10 million gold ounces longer term and the ongoing production expansion to 220,000 to 250,000 ounces per annum; evidence that the hanging wall and footwall of the broader 14km long reserve defined system are prospective for additional near-surface discoveries; the initial step-out results support the interpretation that P16 is a sub-parallel trend to the P17 Trend, which significantly expands the exploration model and potential within this region of the project; and significant potential remains to extend resources to the north of the existing open pit designs in the North Zone.

All forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements including, but not limited to, terrorist or other violent attacks, the failure of parties to contracts to honour contractual commitments, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; social or labour unrest; changes in commodity prices; unexpected failure or inadequacy of infrastructure, the possibility of project cost overruns or unanticipated costs and expenses, accidents and equipment breakdowns, political risk, unanticipated changes in key management personnel, the spread of diseases, epidemics and pandemics diseases, market or business conditions, the failure of exploration programs, including drilling programs, to deliver anticipated results and the failure of ongoing and uncertainties relating to the availability and costs of financing needed in the future, and other factors described in the Company's most recent annual information form and management’s discussion and analysis filed on SEDAR+ on www.sedarplus.ca. Readers are cautioned not to place undue reliance on forward-looking statements.

Forward-looking statements are based on the applicable assumptions and factors management considers reasonable as of the date hereof, based on the information available to management at such time. These assumptions and factors include, but are not limited to, assumptions and factors related to the Company’s ability to carry on current and future operations, including: development and exploration activities; the timing, extent, duration and economic viability of such operations, including any mineral resources or reserves identified thereby; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the Company’s ability to meet or achieve estimates, projections and forecasts; the availability and cost of inputs; the price and market for outputs, including gold; foreign exchange rates; taxation levels; the timely receipt of necessary approvals or permits; the ability to meet current and future obligations; the ability to obtain timely financing on reasonable terms when required; the current and future social, economic and political conditions; and other assumptions and factors generally associated with the mining industry.

Although the forward-looking statements contained in this press release are based upon what management of the Company believes are reasonable assumptions, the Company cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this press release and are expressly qualified in their entirety by this cautionary statement. Subject to applicable securities laws, the Company does not assume any obligation to update or revise the forward-looking statements contained herein to reflect events or circumstances occurring after the date of this press release.