Mine Life increased to 11 years, 24.4% after tax IRR and AISC of US$678/oz

Orezone Gold Corporation (ORE-TSX) is pleased to announce the highlights of the independent Feasibility Study (the “Study”) for its wholly owned Bomboré Gold Project in Burkina Faso, West Africa. The study envisions a shallow open pit mining operation with a processing circuit that combines heap leaching and carbon-in-leach (CIL) without any grinding to process the soft and mostly free digging oxidized ores. The eleven-year mine plan, based on a mineral reserve using an US$1,100 gold price, is designed to deliver higher grade ore in the early years (0.88 g/t over the first eight years of production at a strip ratio of 1:1). Lower grade stockpiles will be processed in the final three years. The financial model with revenues based on a US$1,250 gold price, yields a robust 24.4% after tax internal rate of return to the Company (based on 90% ownership, 10% Gov’t) with a net present value of US$196 M at a 5% discount rate. Project payback is estimated at 2.7 years with all in sustaining costs averaging $678/oz. Initial capital is estimated at $250.0 M including contingencies, all working capital and a $10.5 M credit for gold revenues generated during the pre-production period. Capital costs include the mining fleet, a much larger water storage reservoir and higher resettlement costs than envisioned in the March 2014 Preliminary Economic Assessment (PEA). Sustaining capital is estimated at $75.2 M, taking into account the additional three years of mine life and higher resettlement costs than estimated in the PEA. Total reclamation and closure costs are estimated at $22.5 M including $8.7 M of heap rinsing costs expensed in year 12.

“The results of the Study are compelling and the project benefits from size, location, low reagent consumption, rapid leaching kinetics and low all-in operating costs,” said Ron Little, CEO of Orezone. “Bomboré is one of the largest and most advanced undeveloped gold deposits in the region that lends itself to phased development. The initial 11 year phase requires less capital and has lower operating costs to process the shallow and softer oxidized ores. A second phase, at slightly higher gold prices (>US$1,400) could expand the standard CIL circuit with the addition of grinding to process the well-defined sulphide resource (73 Mt at 1.1 g/t for 2.6 Moz).”

The Study was completed by Kappes, Cassiday and Associates of Reno (“KCA”, Processing and Study Manager), Golder Associates, Inc. of Reno and Montreal, (“Golder”, Geotechnical), RPA Inc. of Toronto (“RPA”), Reserves and Mining) and WSP Canada Inc. of Montreal (“WSP”) in conjunction with Socrege and BEGE of Burkina Faso (Social & Environmental).

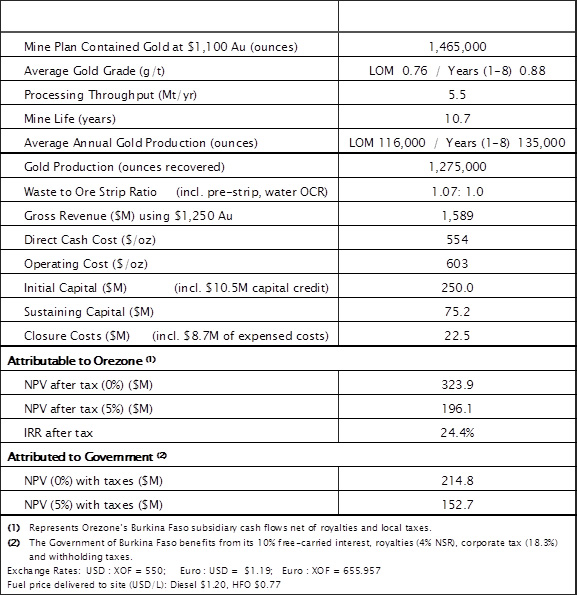

Summary of Financials

The Base Case assumptions include mineral reserves using an average gold price of $1,100/oz and revenues based on $1,250/oz along with current prices for fuel, reagents and labor. Capital is based on quotes received from potential equipment and service providers between Q3 2014 to present. The financial highlights are as follows:

Base Case Highlights

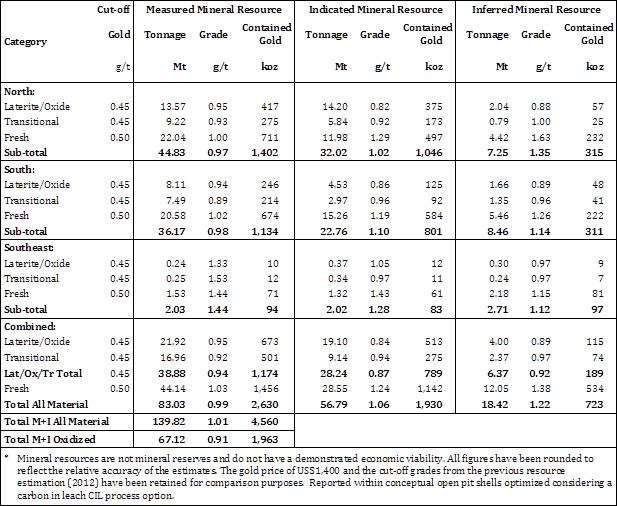

The Mineral Resource and Mineral Reserve

The Mineral Reserve estimate prepared by RPA, is based on the 2013 Mineral Resource estimate prepared by SRK Consulting (Canada) Inc., which includes 139.9 Mt of M&I resources grading 1.01 g/t for 4.6 Moz plus 18.4 Mt Inferred resources grading 1.22 g/t for 0.7 Moz. The Study mineable reserve is limited to only the measured and indicated near-surface saprolite (oxide) and transitional (semi-oxidized) resources to an average depth of 45 m.

The Mineral Resource estimate consists of three separate block models:

- The North model, which consists of the KT, Maga, CFU, OCR, and P8P9 zones.

- The South model, which consists of the P11, Siga E, and Siga W zones.

- The Southeast model, which is to the south and southeast of the South model and consists of the P16 and P17 zones.

Mineral Resource Estimate – SRK Consulting (Canada) Inc., April 26, 2013

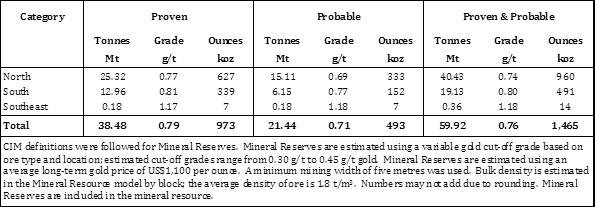

For the Mineral Reserve estimate,RPA developed reserve block models, for each of the three resource block models, by applying modifying factors for conversion of Mineral Resources to Mineral Reserves. Those factors included amongst others, weathering profiles, operating costs, metallurgical recoveries, mining dilution & extraction and pit slopes.

Mineral Reserve Estimate – RPA, March 20, 2015

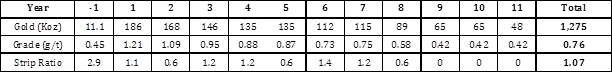

Estimated Annual Gold Production

The Study assumes during years 1 through 8 an average annual mining rate of 13.9 Mt, including 5.5 Mt of ore. The ore is composed almost equally of +/- 212 micron material and is processed via the heap leach pad (+212 micron) and CIL (-212 micron) circuits. Average gold produced, average diluted grades and waste to ore strip ratios for each year are summarized in the table below. Some gold is recovered during the pre-production period (Year -1) as a result of mining and processing the ore contained within the water storage facility (OCR). During years 9 to 11 ore is only processed from the lower grade stockpiles.

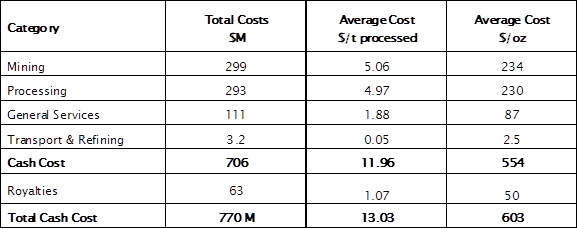

Summary of Operating Costs (excluding pre-production period)

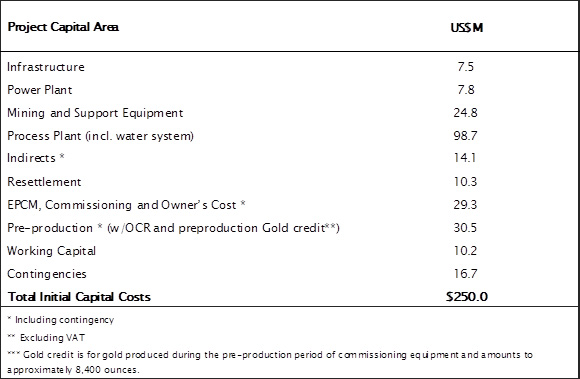

Initial Project Capital Cost Estimates

Initial capital costs are based on quotes of equipment and services from potential providers.

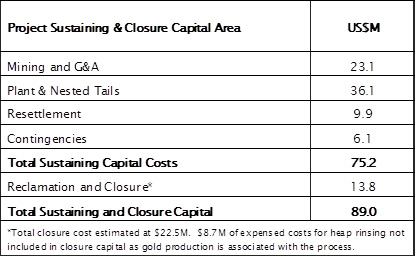

Sustaining Capital & Closure Cost Estimates

Sustaining capital costs were estimated on the basis of quotes on equipment from potential providers. Taxes and freight are included along with the individual items. The closure and reclamation plan includes work to be conducted from the closure of the mine at the end of operating activities, as well as progressive rehabilitation work during the life of the mine. The goal is to return the site to a satisfactory state as quickly as possible in terms of reducing the risks for health and safety, controlling erosion and developing a profile compatible with the future uses of the site.

Total LOM reclamation and closure costs are estimated to be $22.5 M including $8.7 M in expensed operating costs for heap rinsing in year 12. The additional $13.8 M in capital and $8.7 M in expenses are included in the LOM AISC estimate of $678/oz. An estimated equipment salvage value of $9.6 M has been included as a credit.

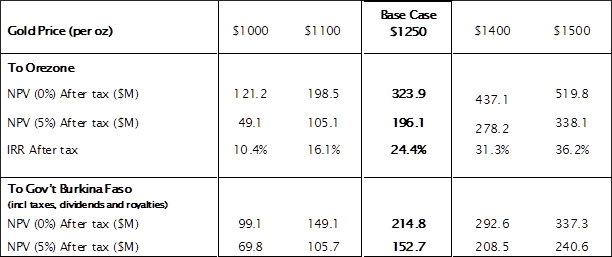

Project Sensitivities

The project is sensitive to gold price as demonstrated in the following table:

The project is also sensitive to operating costs, in particular fuel (diesel and HFO) which accounts for approximately 25% of expenses. Diesel pricing is set by the government of Burkina Faso. The Study uses the conservative delivered to site fuel prices of $1.20/L for diesel and $0.77/L for HFO. Although diesel prices are lower than those used in the 2014 PEA, they are not as low as the current price in Burkina Faso or the free market price. The project economics and other mining operations in the country would benefit if the government were to change their policy to allow free market pricing and direct supply.

Mine Plan and Pit Optimization Studies

The Company has worked with RPA to develop a mine plan and production schedule (based on the April 2013 resource model). Scheduling has been optimized for project returns by processing the higher grade ore in the early years and stockpiling the lower grade ore for processing after mining is complete in year 8. Initial process grade for years 1 through 3 averages 1.08 g/t, with the years 1 through 8 averaging 0.88 g/t. A fleet of 32 tonne haul trucks, such as Volvo or Scania rear-dump units, will be used to provide increased versatility, as the mine plan consists of a large number of shallow pits of varying tonnage.

Total ore processed, including the lower grade stockpiles, will be 59.9 Mt of oxide and semi-oxidized ore grading an average of 0.76 g/t. The life of mine strip ratio is approximately one tonne of waste per tonne of ore.

Metallurgical Test Results

KCA has completed all of the metallurgical testing associated with the Bomboré project Study and have reviewed the historical data. Results indicate that the overall recovery for the combined heap leach and CIL processing circuit is expected to be 87%. The circuit separates the fine ore (-212 micron) from the coarse ore in a cyanide solution via a rotary scrubber, screen and classifiers. The slurried fine ore (49% of the total) is pumped to a CIL circuit for gold recovery without any grinding. The CIL tails are sent to a lined tailings facility that utilizes the heap leach as part of the containment system in order to reduce the footprint and liner costs. The tails facility is designed to be zero discharge. The coarse (+0.212 mm) fraction is conveyed to a standard heap leach pad, where it is leached with a cyanide solution. With the majority of the fines removed from the coarser heap leach ore, there is no requirement for cement agglomeration or inter-lift liners for a stacking height of up to 60 m. The pregnant liquor from the heap leach is sent to the CIL circuit for gold recovery. Gold is recovered in a standard carbon desorption plant, finishing with electrowinning and smelting to produce gold doré bars.

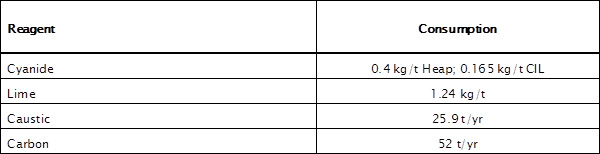

Maximum power requirement will be 7.2 kWh/t ore. Overall reagent consumptions are given in the table below.

Reagent Consumption

Development Timetable

Estimated time to construct the Bomboré operation (pre-production) is 21 months, including time to excavate the Off Channel Reservoir (OCR) to be used for project water storage, and time to commission the process plant equipment.

Water for the operation will be collected by gravity feed into the OCR from about 10% of the annual rainy season runoff from the Nobsin River drainage basin. The OCR usable volume design capacity is 3 M cubic meters, and significantly larger than those designs presented in the 2014 PEA (0.9 M cubic meters). Annual water consumption for the project is calculated to be, on average, between 2.6 M and 2.9 M cubic meters per year and considers recycle of tailings solution. The increase in annual water consumption as compared to the 2014 PEA is due to the change in the process from 100% Heap Leach to a combined Heap Leach/CIL process.

Environmental Studies and Social Responsibility

The Environmental Baseline Studies for the Bomboré Project began in 2011 and were completed at the end of 2014. Local consultants have conducted archaeological studies and a comprehensive range of environmental and social impact studies. Their work is supported by WSP who were retained by Orezone early in 2014 to support and audit the Bomboré ESIA study and resettlement action plan (“RAP”).

Over the past 5 years the Company has recognized and accepted its social responsibility by actively supporting local communities by sponsoring over 50 initiatives which included improvements and additions to local schools, clinics, water wells and supply inventories. Orezone have on staff technically qualified personnel, sociologists and managers experienced with mining and resettlement projects in Burkina Faso. With the help of our employees, consultants and community leaders the Company is currently developing plans to pursue these community projects in the coming weeks, months and years.

The Company continues to hold formal and informal information meetings with the community leaders to update them regularly on the status of the Bomboré study. In order to ensure safe operations, the project will require the relocation of over 500 local households (approximately 3,700 residents) from several communities and two artisanal mining sites over the initial 5 years of construction and operation. The program for this relocation has been the object of joint discussions involving the communities affected, their representatives, the Company and its local consultants Socrege. A detailed analysis based on these discussions has led to a substantial increase in relocation and resettlement cost as compared to the 2014 PEA. The main areas where estimated costs increased were building replacement, artisanal miner compensation, infrastructure crop and tree compensation and livelihood compensation. Pre-production costs for the resettlement program are now estimated at $10.3 M, with life of mine costs estimated at $20.2 M.

Full details of the Feasibility Study in the form of a NI 43-101 technical report will be filed on SEDAR within the next 45 days. The Company is also in the process of updating the 2013 Mineral Resource estimate with the inclusion of an additional 50,000 m of drilling. The update will be completed by Q3 2015 and if warranted, an update to the Mineral Reserve and mine plan will be completed prior to any production decision.

About Orezone Gold Corporation

Orezone is a Canadian company with a gold discovery track record of +12 Moz and recent mine development experience in Burkina Faso, West Africa. The Company owns a 100% interest in Bomboré, the largest undeveloped oxide gold deposit in West Africa which is situated 85 km east of the capital city, adjacent to an international highway. The Company is the process of updating the Mineral Resource estimate, completing the Feasibility Study and filing an application for a mining permit on Bomboré in H1 2015.

For further information please contact Orezone at +1 613-241-3699 or Toll Free: +1 888-673-0663

Carl Defilippi of Kappes, Cassiday & Associates; Glen Ehasoo of RPA Inc.; Todd Minard of Golder Associates Inc., Craig Wood of WSP, Glen Cole of SRK Consulting (Canada) Inc., Tim Miller, COO, Pascal Marquis, SVP and Ron Little, CEO of Orezone, are Qualified Persons under National Instrument 43-101 and have reviewed the information in this release.

FORWARD-LOOKING STATEMENTS AND FORWARD-LOOKING INFORMATION: This news release contains certain “forward-looking statements” within the meaning of applicable Canadian securities laws. Forward-looking statements and forward-looking information are frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “potential”, “possible” and other similar words, or statements that certain events or conditions “may”, “will”, “could”, or “should” occur. Forward-looking statements in this release include statements regarding, among others; completing a full feasibility study for Bomboré and applying for a mining permit in H1 2015, updating the Bomboré resource estimate by Q3 2015 and if warranted update to the mineral reserve and mine plan prior to a production decision, the Government of Burkina Faso making changes to fuel price policies that might benefit the project, and a second phase could expand the standard CIL circuit with the addition of grinding to process the well-defined underlying sulphide resource.

FORWARD-LOOKING STATEMENTS are based on certain assumptions, the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. These factors include the inherent risks involved in the exploration and development of mineral properties, the uncertainties involved in interpreting drilling results and other geological and geotechnical data, fluctuating metal prices, the possibility of project cost overruns or unanticipated costs and expenses, the ability of contracted parties (including laboratories and drill companies to provide services as contracted); uncertainties relating to the availability and costs of financing needed in the future and other factors. The Company undertakes no obligation to update forward-looking statements if circumstances or management’s estimates or opinions should change. The reader is cautioned not to place undue reliance on forward-looking statements. Comparisons between any resource model and estimates with the subsequent drill results are preliminary in nature and should not be relied upon as potential qualified changes to any future resource updates or estimates.

Readers are advised that National Instrument 43-101 of the Canadian Securities Administrators requires that each category of mineral reserves and mineral resources be reported separately. Readers should refer to the annual information form of Orezone for the year ended December 31, 2014 and other continuous disclosure documents filed by Orezone since January 1, 2015 available at www.sedar.com, for this detailed information, which is subject to the qualifications and notes set forth therein.